There has been always a debate about the monetary union of EU in international markets. It mostly fits for the German economy since 59% of German exports are done among the EU members. Therefore integrity of Eurozone and European single market is vital for Berlin. Secondly, Euro cannot be devaluated as desired since control of euro belongs to European Bank. That creates a significant advantage to Germany. Imagine if price increase or if EU would be devaluated, how German economy will be affected. Therefore Germany is very strict on price stability as well as inflation and control of European Central Bank.

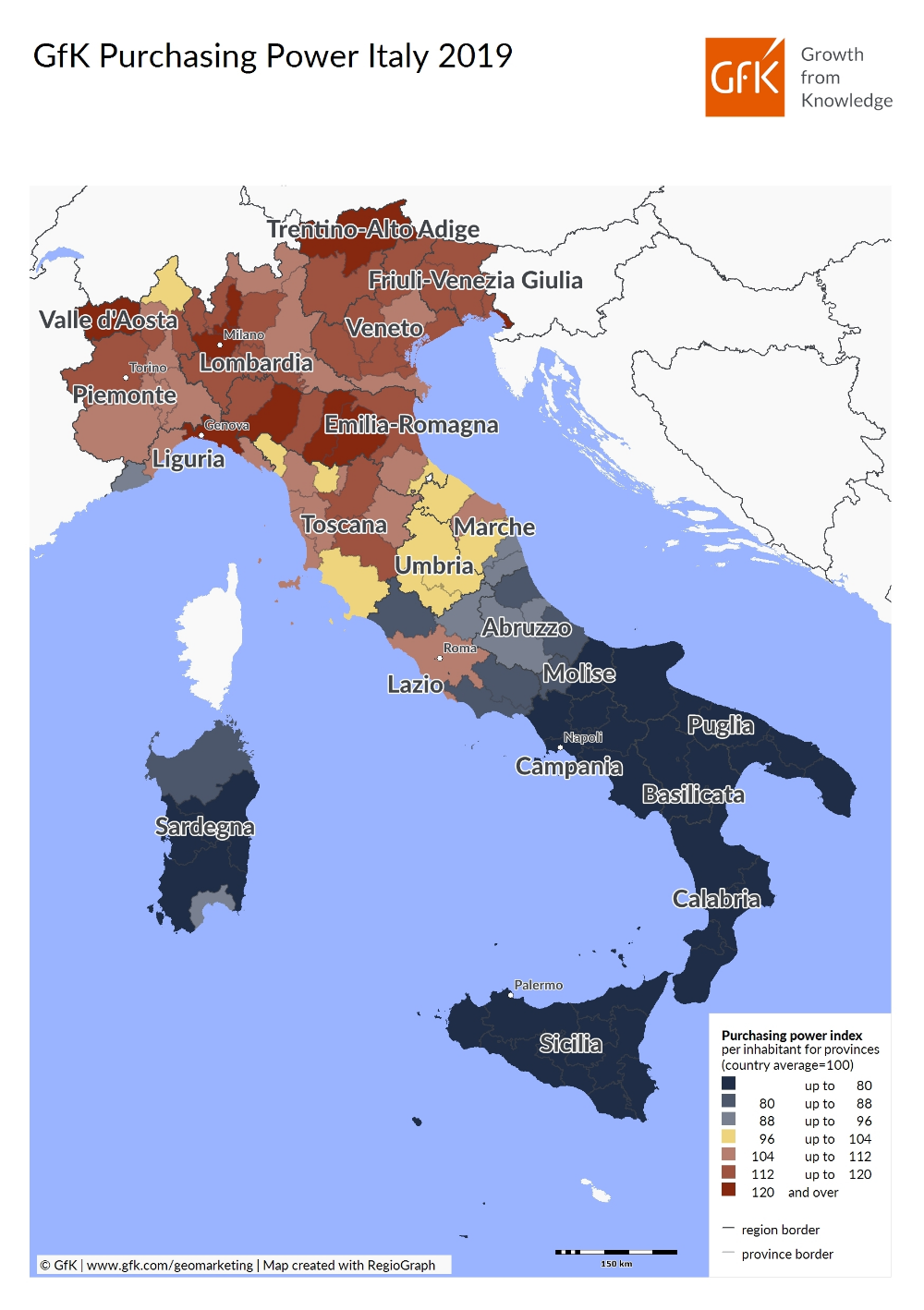

When it comes other countries, the picture is different. For example Italy, it struggles to balance the GDP among its own region. The rich regions has 48100 euro/year GDP in north nearly two fold of Sicily in south with 20000 euros/year. Therefore, the parties with national sayings could channel this frustration into votes. The main problem is not only geography in Italy. The industrial zone is much developed in northern part. It has good access with Europe. Thus, reflects into business. For example Lombardy and Germany exceeded 40 billion euros which is almost the same size trade Germany with Japan trade.

In order to inject more liquidity into the market, Rome has the options to devaluate the Italian lira whenever needed. Following the monetary union, Italy is left with one option; to compress the salaries to regain the competitiveness. And Italy has been following that policy but with consequences in the elections.

Low inflation which Germany wants to achieve in EU zone, has been slashing the Italian economy with consumption and investment. Italy needs easy money to balance the debt sustainability which fluctuates around 150% amid the economic downturn brought on by the pandemic. Before that it was around 135% between 2014 – 2019.

Following 2008 crisis, ECB loosened its monetary fiscal policy to avoid deflations. With Mario Draghi leadership, ECB applied Asset Purchase Program which intended to reduce the long low inflation while helping problematic countries to sustain their debt problems. However, Germany feels that ECB is exceeding its limits.

In 2020, German Federal Constitutional Court ruled that ECB bond-buying program was partially unconstitutional and ECB acted beyond its limits. That was a signal that ECB and Germany was in dispute about the economic future of ECB. Germany insists that ECB should end the pandemic program as well as Asset Purchase Program when possible or as soon as possible since as German CB states “ECB’s responsivity is not to take care of solvency security of the states”.

Germany is aware that ECB does not follow the leadership of Germany as once did. Inflation is not matter of countries due to geography but due to geopolitical issue among EU zone. Despite the fact that monetary union was believed to bring cohesion amount EU countries, it brought increasing tension since each member requires different approach to their problems. Italy is in bad economic situation and any default scenario might cause serious consequences not to EU but to global markets. EU has to comprise. The result will not be unsatisfactory and inadequate for most parties.

There will be more fractions among EU members due to economy and priorities to solve their problems. There will be no tailored solution for any members. The future of EU depends on how they will show solidarity during time of socio-political instability.